Looking To Get Your Deal Funded FAST?

What type of lending are you looking for?

Here's How The Process Works:

Borrowing For EMD

Submit your request with all the necessary information.

Wait for our team to approve your request.

Complete the contracts and email them to the title company.

Get your deal funded!

Stay in touch with us until the closing.

Borrowing For A Double Closing

Submit your request with all the necessary information.

Wait for our team to approve your request.

Have the title company reach out when the A-B HUD is ready.

We will send a payoff to the title company for the B-C HUD.

Both you and Allbridge Consulting LLC will approve the final HUD.

We fund as soon as the B-C funds are received!

Ya, Its really That Easy!

100s

Deals Completed

$5M+

Funded

100s

Client Transactions Funded Nationwide

What're The Fees?

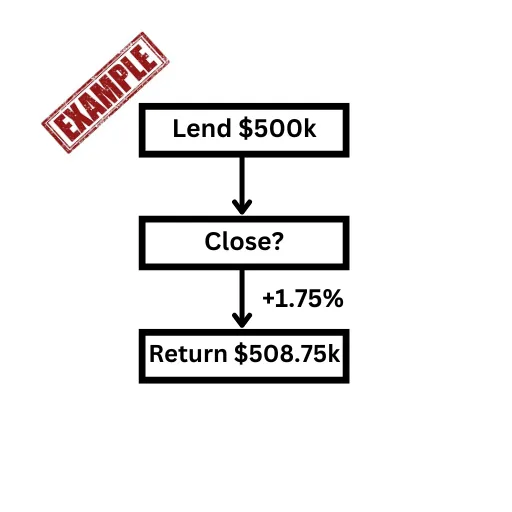

Double Close Funding

We charge a flat 1.75% fee on all double closings with at least 7 days' notice. For expedited funding, please email [email protected] to confirm availability. Our minimum return is $1,250 for smaller deals.

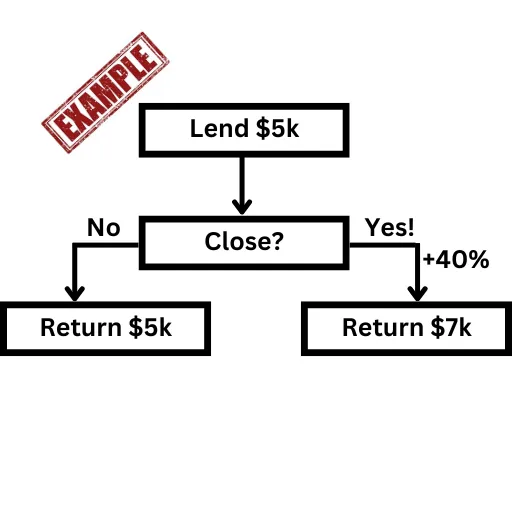

EMD Funding

We charge a flat 40% return on all EMD deals. This means if the deal closes, we receive the initial amount plus 40%. Additionally, there is a non-refundable fee of $250 prior to funding your deal, which covers our transaction coordinator's time in case the deal doesn't close.

Frequently Asked Questions

What is a Double Closing?

A double closing is a real estate transaction method where two back-to-back property sales occur on the same day, involving three parties: the original seller, the investor (middleman), and the end buyer. Here’s how it works:

1. First Transaction: The investor agrees to purchase the property from the original seller.

2. Second Transaction: The investor simultaneously sells the property to the end buyer at a higher price.

During a double closing, the investor typically uses the funds from the end buyer to complete the purchase from the original seller. This allows the investor to profit from the difference in sale prices without needing to use their own funds for an extended period.

Double closings are commonly used in real estate wholesaling and transactional funding, enabling investors to efficiently facilitate deals and earn profits by connecting motivated sellers with interested buyers.

How much money are you able to fund at once?

There is no limit to the funds we have available for both EMD and double closings. As long as your deal meets our standards, we will be your one-stop shop for all transactional funding needs, now and in the future!

How fast can you fund my deal?

We usually require 7 day notice to fund a deal, but we have funded deals in as little as 5 minutes (yes, really). To ensure the best chance of a quick turnaround, submit your deal as soon as possible so we can review it and get the process underway. For expedited funding, please email [email protected] to confirm availability.

What happens if my EMD deal doesn't close?

If your deal does not close, we do not charge the 40% fee. Your only cost will be the upfront fee, which covers the work our transaction coordinators have already done for you.

Can you fund EMD for end buyers?

We can fund EMD for end buyers, but it's uncommon. Our priority is to ensure our funds are protected. Typically, this is achieved through an inspection period. If your deal lacks an inspection period or if the EMD is non-refundable, we will not fund it. However, if an inspection period is in place, we can temporarily fund your deal, provided our funds are replaced before the inspection period ends.

What qualifies as EMD lending?

EMD stands for Earnest Money Deposit. It is a sum of money that a buyer provides to a seller as a show of good faith when entering into a real estate contract. The EMD is typically held in escrow until the transaction closes.

To determine if your request qualifies as EMD, consider the following:

1. Is the requested amount exactly the same as the amount listed for EMD on the contract?

2. Does the requested amount include an option fee? We will not fund those!

3. Are you requesting money post-closing? That is not EMD, and we will not fund it.